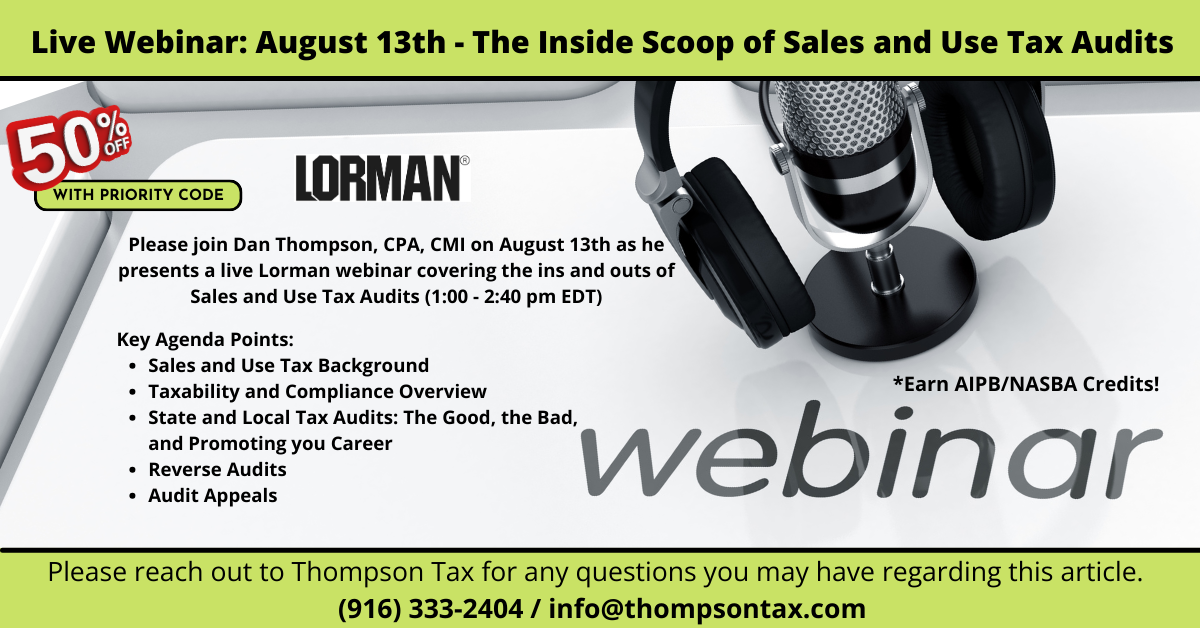

Join Dan Thompson, CPA, CMI, on August 13th to gain a better understanding of the intricacies of navigating a Sales and Use Tax audit from start to finish.

States rely on sales and use tax audits to ensure compliance among registered taxpayers. With the rise of remote sellers post-Wayfair, states are auditing more than ever to ensure applicable businesses are registered and are complying with sales and use tax collection rules and regulations.

It is now more important than ever to understand the entire process, from selection through appeals, and how to expertly navigate a sales and use tax audit. This webinar will give you the inside scoop on how to identify the important factors involved in state sales and use tax audits and how to communicate and work with taxing jurisdictions.

Please join us!

If interested, please contact Lori prior to registering at lori@thompsontax.com for a 50% off discount code.

The Inside Scoop of Sales and Use Tax Audits – Live Webinar | Lorman Education Services