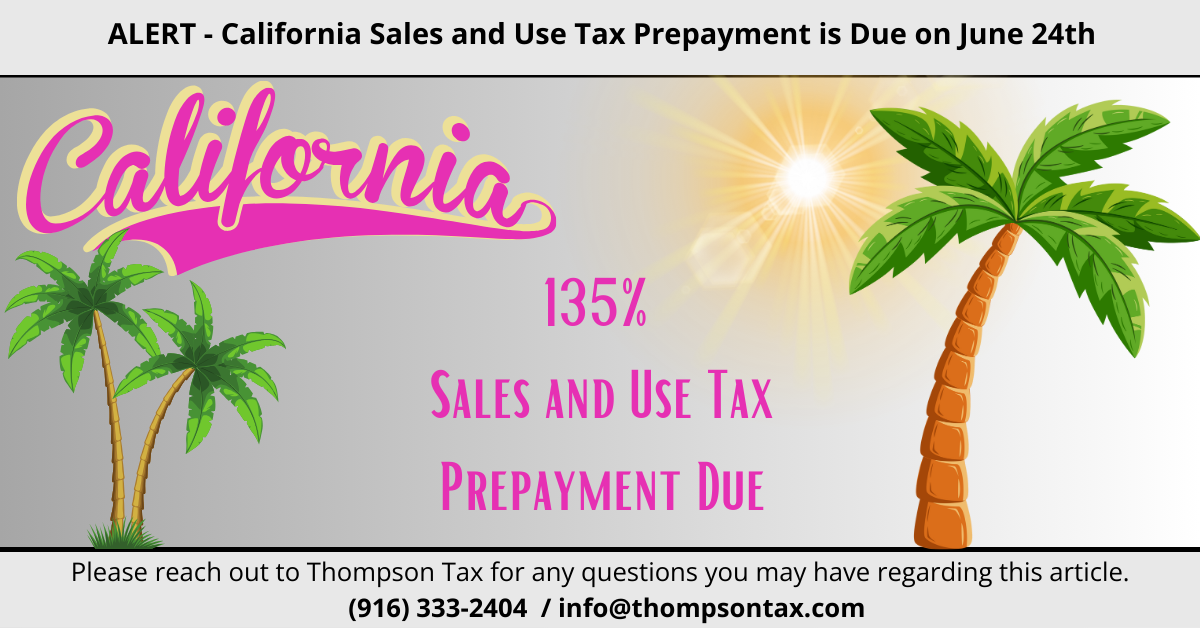

As a business owner in California, it is important to be aware of the upcoming deadline for the 135% sales and use tax prepayment, which is due on June 24th. This prepayment is meant to help the state manage its cash flow and ensure that its tax revenue is received in a timely manner.

Why Is It Important to Stay Updated with Tax Deadlines?

Staying informed about tax deadlines and requirements is essential to running a business. By meeting the obligations set forth by the state, companies can avoid unnecessary complications and maintain good standing with the tax authorities.

Next Steps

Eligible businesses should make the necessary arrangements and submit the prepayment on time to avoid penalties and interest. You can refer to the instructions provided by the California Department of Tax and Fee Administration (CDTFA) or consult with a tax professional, such as Thompson Tax, for guidance on calculating the prepayment amount.

Reach out to us today! We are your Trusted Tax Advisors and are always just a phone call away.